Planning a baby shower or baby sprinkle can almost feel like planning a wedding. As the host, you surely want the party to be perfect for the expectant parents you're celebrating, and there are quite a few things to plan for. Here's a simple checklist you can follow to make the party-planning process easy and fun.

Think about the basics

First, decide where the party will be held. You might choose a spot the parents-to-be love, whether it's a restaurant they're partial to, a family member's house or a park they frequent. A virtual baby shower might also make sense if potential attendees live far away.

Next, work with the parents-to-be to finalize the guest list. Would a small, intimate gathering alleviate any baby shower anxiety — or maybe they'd prefer a big coed baby shower with all of their friends and family?

As for when to schedule a baby shower, there's no right or wrong time. Many parents-to-be prefer the second or early- to mid-third trimester. By then, the mom-to-be is showing and her baby registry (or sprinkle registry) is set up, but she's not so close to her due date that she feels overly tired.

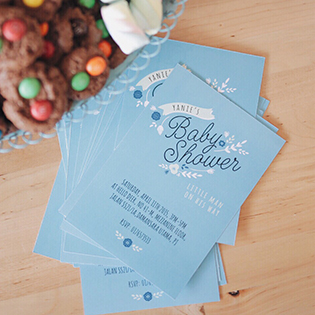

Send the invitations

Next on your list is to let guests know about the event by sending out invitations. Include essential information such as the time, date, location, honoree and host as well as RSVP details and registry information. A little bit of baby shower etiquette: Aim to mail (or email) invitations at least four weeks before the event.

Decide on a baby shower theme

Once you've checked the basics off your list, it's time for the fun part: planning the party! It may feel like there are tons of to-dos, but one of your first decisions can help dictate the rest: choosing a theme.

Read This Next

While it's certainly not essential, many hosts find that it's helpful to have a baby shower theme. A theme helps everything else come together seamlessly, from what your invitations will look like to the decorations that you'll use.

Not sure how to pick a baby shower theme? Find inspiration in a favorite children's book (like Goodnight Moon or The Velveteen Rabbit), a sweet animal (such as owls, rabbits or storks), the guest of honor's favorite locale (Paris-themed for an all-things-French lover, for example) or the baby's due date (for a fall or winter baby shower, for example). Think about what the parent-to-be would enjoy to make it personal and extra-special.

Plan the menu

Serve up some of the mom-to-be's favorite foods, or choose a baby shower menu that sticks with the theme or color palette. Some little touches you can incorporate: a rainbow-of-fruit display, a pregnancy-safe and Pinterest-worthy charcuterie board or an ice cream sundae bar. A beautifully decorated baby shower cake or cupcakes can add a little extra sweetness.

For drinks, consider DIY cocktails and mocktails or a batch of baby shower punch. Hosting the shower virtually? You might send guests a simple list of ingredients to create a fun beverage ahead of time, and virtually toast when you're all together on camera.

Set the stage with baby shower decorations

Baby shower decorations can be elaborate (a welcome sign, table centerpieces and balloons) or relatively simple (just some flowers). You don't have to go all-out and revamp the space. Instead, zero in on a few noteworthy details, from a pretty buffet table to an aesthetically pleasing photo wall, for example. DIY baby shower gifts like a diaper cake or a baby mobile can also add some visual interest and go home with the guest of honor after the event.

If your baby shower is virtual, consider sending guests a special Zoom background that will make everyone feel connected even when they're physically apart.

Have fun with baby shower games

While your guests enjoy chatting, eating and watching the guest of honor open her baby shower cards and gifts, it doesn't hurt to fill out the party itinerary with a few fun activities. You might prefer planning one big activity, like asking everyone to decorate plain white onesies for the new baby or one fabric square of a quilt, or a number of smaller (but equally entertaining) baby shower games.

Games not only make the baby shower memorable, but they're also great for breaking the ice. ("What's your favorite memory of the parent-to-be?") You don't have to spend a lot, either; pass out some free printable baby shower games and some pens and pencils, and you're good to go.

Consider personal touches

Don't forget that the party is in honor of the parents-to-be, so shower them with a few of their favorite things. Make sure the menu includes some of their faves, and throw in a few extras they'll get a kick out of: their favorite songs on a playlist, flowers they love on the table or some festive photo booth props specific to their interests.

Speaking of photos, they're an easy way to personalize any party, and baby showers are no exception. Go with baby pictures of the parents-to-be (and even of the future grandparents, aunts and uncles) or cute shots of the guest of honor at various stages of her pregnancy — or all of the above. You can display them in frames on the tables or a mantle, string up copies with baby-size clothes pins over the buffet or include them in other details, like the invitations.

Select baby shower favors

Baby shower favors aren't essential, but it's always a nice gesture to give guests a token thank-you gift as they head out. You don't need anything big — scented body wash, sweet treats or a small potted plant are all thoughtful choices. You can even send guests home with something from the event itself, like a bud vase with a single bloom from the tables or a pretty gift bag full of candy from the dessert buffet.

Or, opt for DIY favors that your guests work on during the shower, like a sugar cookie they decorated or a little potpourri sachet they made. Another option: Dress up store-bought favors with some creative packaging that's in line with your theme.

No matter how elaborate or simple you go, get help from those close to the parent-to-be. It will all come together beautifully for a baby shower they'll never forget!

Trending On What to Expect

Trending On What to Expect