You’ve finally put 40 (or so) weeks of pregnancy and long hours of childbirth behind you, and you’re officially a mother. Congratulations!

Now comes the transition from pregnancy to postpartum, which brings with it a variety of new symptoms and questions.

Here’s what you need to know about your postpartum body and its recovery from childbirth.

How long does it take to recover after giving birth?

No matter how you gave birth, the first six weeks postpartum are considered a “recovery” period. Even if you sailed through your pregnancy and had the easiest delivery on record (and especially if you didn’t), your body has been stretched and stressed to the max, and as you can already tell, it needs a chance to regroup.[1]

Keep in mind that every new mom is different, so every woman will recover at a different rate with different postpartum symptoms. The majority of these ease up within a week, while others (sore nipples, backaches and sometimes perineal pain) may continue for at least a few weeks, and still others (like leaky breasts) might stick around until your baby is a little older.

If you’ve had a vaginal birth, you’re probably also wondering how long it will take for soreness to go away and your perineum to heal. Recovery can take anywhere from three weeks if you didn’t tear to six weeks or more if you had a perineal tear or an episiotomy. To ease discomfort, your doctor may advise you to try sitting on a pillow or padded ring, or cooling the area with an ice pack. A warm sitz bath can also help.

Wondering if your vagina will ever be the same after birth? Not exactly — though it will likely be very close. Expect the swelling to recede, and within a few weeks your vagina will have contracted and regained much of its muscle tone. Your uterus should also be back to its normal size by the sixth week. If you have any concerns, be sure to express them to your doctor.

Read This Next

If you delivered by C-section, expect to spend the first three to four days postpartum in the hospital recovering; it will take four to six weeks before you’re feeling back to normal. Depending on whether you pushed and for how long, you can also expect to have some perineal pain.

Walking after a C-section can help speed up your recovery. But everyone is different, so chat with your OB/GYN or midwife about how much walking you should do and when it's okay to start. Your doctor may also prescribe pain medication as you heal.

How much bleeding is normal after giving birth?

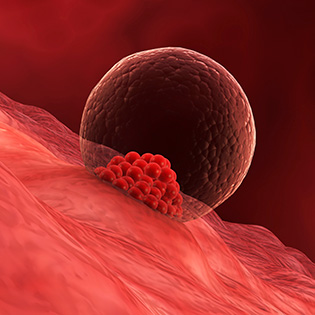

After you give birth, postpartum bleeding — i.e. lochia — can last for up to six weeks. This is the body’s way of healing itself, is completely common, and is usually nothing to be concerned about. It will be just like a very heavy period made up of leftover blood, tissue from your uterus, and mucus.

Bleeding is heaviest for the first three to 10 days, then it will taper off — going from red to pink to brown to yellowish-white. During this time, tampons are off-limits, so you’ll have to rely on pads.

It’s also not unusual to have some ebbs and flows of your bleeding pattern. Often, as you become more active in week three or four after delivery, the bleeding will increase slightly. This is also normal.

However, if you pass large clots or you’re bleeding through more than one pad every hour, call your doctor right away to rule out postpartum hemorrhage, a serious but rare occurrence that usually happens within the first day after giving birth (but can also happen in the first 12 weeks after delivery).

How can you speed up the postpartum healing process?

The following tips can help you to speed up your postpartum recovery, so you can heal a bit faster and feel better in the process:

- Help your perineum heal. Ice your perineum every couple of hours for the first 24 hours post-birth. Spray warm water over the area before and after peeing to keep urine from irritating torn skin. Try warm sitz baths for 20 minutes a few times a day to ease pain. If you don't have an actual sitz bath, it can be as simple as a nice soak in your bathtub, with no special salts or soaps required. Aim to avoid long periods of standing or sitting, and try to sleep on your side.

- Care for your C-section scar. Gently clean your C-section incision with soap and water once a day. Dry completely with a clean towel. Talk to your doctor about whether it’s better to cover the wound or leave it uncovered to air out. Avoid carrying most things (besides your baby), and hold off on vigorous exercise until you get the okay from your doctor.

- Ease aches and pains. If you’re achy from pushing, take acetaminophen or ibuprofen. Ibuprofen is usually preferred when breastfeeding, as little of it passes to your baby and it acts as an anti-inflammatory, which works better on crampy pains. However, either can be used. Ease overall achiness with hot showers or a heating pad — or even treat yourself to a massage.

- Stay regular. Your first postpartum bowel movement can take time, but don’t force things. Eat plenty of fiber-rich foods (whole grains, fruits, such as kiwis and leafy green vegetables), go for walks, and discuss the use of gentle stool softeners with your doctor. Avoid straining, which isn’t ever a good idea but is definitely not recommended postpartum — it can up the chance of severe hemorrhoids, delay perineal healing, and increase the risk of incisional hernias.

- Do your Kegels. Practice postpartum Kegel exercises alone or with a physical therapist to help improve postpartum urinary incontinence and restrengthen the muscles of your pelvic floor — no matter how you delivered. Aim for three sets of 20 every day. But don’t push it. There’s no rush to do Kegel exercises and certainly no need when you are still hurting. If you do not start till after your postpartum doctor's visits, your body will be just fine.

- Be kind to your breasts. For sore breasts, try using a warm compress or ice packs and gentle massage. Also be sure to wear a comfortable nursing bra. If you’re breastfeeding, let your breasts air out after every nursing session and apply a lanolin cream to prevent or treat cracked nipples.

- Keep your doctor's appointments. Checking in with your doctor is essential, since it can ensure that everything is healing as expected. Your OB/GYN can also help you emotionally and, if necessary, suggest how to get support for any stress associated with being a new mom. If you had a C-section, ask whether any staples or sutures need to be removed, as leaving them in for too long can make scars look worse. And of course definitely let your doctor know if you have any symptoms that concern you, like fever, pain, or tenderness around an incision.

- Eat well to ease fatigue and fight constipation. Just like you did during pregnancy, aim to eat five smaller meals throughout the day instead of three larger ones. Eat a combination of complex carbs and protein for energy, plus plenty of fiber (found in fruits, leafy green vegetables and whole grains) to help prevent hemorrhoids. Think: whole wheat toast with peanut butter, carrots with hummus, or yogurt with a handful of red or blue berries (which contain plenty of healing antioxidants). Drink at least 64 ounces (about eight glasses) of water every day. And limit alcohol and caffeine, too much of which can affect your mood and make it even more challenging to sleep than it already is with a newborn at home.

- Keep moving. Exercise is likely off-limits for at least the first few weeks if you've had a C-section, and you won't be immediately back to hard-core pre-pregnancy workout routines if you had a vaginal birth. But definitely talk to your doctor about when and how you can exercise; you may be able to do more than you think.[2] Generally, start by taking walks — stroll around your house and, eventually, around the neighborhood (stroller in tow!). Walking helps with gas and constipation and speeds recovery by boosting circulation and muscle tone. Plus it boosts your mood and has been shown to help ease depression-like symptoms. Here are some postpartum exercise tips to get started.

Your postpartum recovery checklist

Here are a few things you’ll want to stash away while you’re still pregnant to make your postpartum recovery go as smoothly as possible:

- Acetaminophen and ibuprofen. These OTCs can help with perineal pain and overall aches.

- Maxi pads. You’ll probably need these for at least a couple of weeks, until postpartum bleeding lets up.

- Ice packs. There are lots of ways to ice your perineal area — from frozen padsicles to your standard lunchbox ice blocks (wrapped in paper towels, of course, to avoid frostbite).

- Witch hazel pads. This is often used in combination with ice packs to ease vaginal pain and help with postpartum hemorrhoids. Try keeping them in the fridge; they're very soothing when they're nice and cold!

- Sitz bath. This little tub is designed for you to just sit and soak away postpartum pain. You can also soak in the regular-size bathtub instead.

- Peri or squirt bottle. You’ll use this to rinse off your perineal area before/after going to the bathroom as the area heals.

- Cotton underpants. Go for the “granny” or hospital gauze underwear — comfort is much more important for now than looking sexy.

- Nursing bras. Invest in a few comfy ones that fit you well and give you easy access for breastfeeding and pumping.

- Lanolin. The cream works wonders to prevent and treat cracked nipples.

- Nursing pads. If you’re nursing, these will help keep leaky breasts under wraps.

- Lidocaine spray. It helps ease the pain of postpartum hemorrhoids.

- Stool softener. In case you get stopped up, this can gently help get things going.

- Postpartum recovery belt. If you think you might want one, the Belly Bandit or other similar belt can help keep things in place as your tummy shrinks back to size.

- Heating pad. This can help ease lots of postpartum aches and pains.

What you need to know about postpartum depression

There’s no doubt that having a baby is a life-changing experience. Almost every mom faces a bout of the baby blues due to sudden drop of hormones, lack of sleep, and the struggle to adjust to that tiny new human at home.

That said, if you have symptoms of postpartum depression — including feeling persistently hopeless, sad, isolated, irritable, worthless or anxious — for more than two weeks postpartum, talk to your doctor.

Try not to feel ashamed or alone: Postpartum depression is not your fault, and it affects up to an estimated 1 in 7 new moms. Seek professional help from your health care provider. Try organizations like Postpartum Support International to speak with a volunteer or connect online with a support group, and lean on friends and family.

The postpartum period can be both exciting and overwhelming. Give yourself the grace and patience to settle in as the pain and discomfort from childbirth subside. You’ll get through it and will soon be well on the way to a full recovery. While you're at it, don't forget to enjoy this special stage with your new baby. It will go faster than you think!

Trending On What to Expect

Trending On What to Expect